Muizzu Stands Firm on Foreign Currency Regulation Amid Concerns

President Dr Mohamed Muizzu has reaffirmed his commitment to retaining the newly implemented foreign currency regulations, stating they are essential for addressing long-standing economic issues.

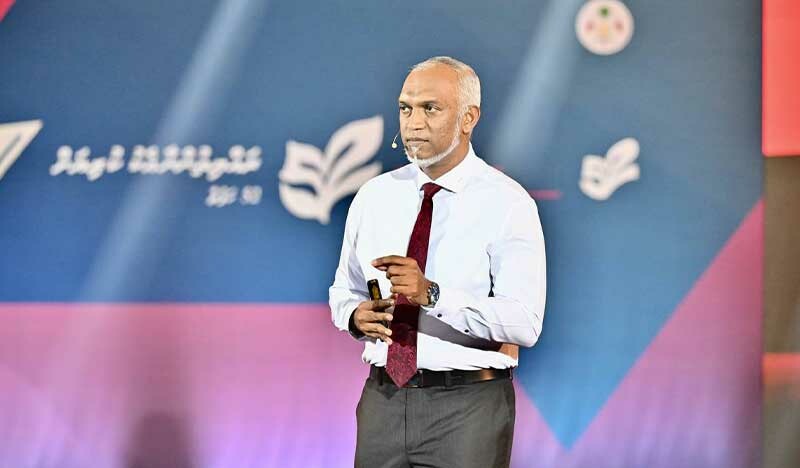

Muizzu made these remarks during a ceremony held at the Social Center in Male’ on last evening, marking the first anniversary of his administration.

Under the new regulation, establishments categorised as ‘A’ – including tourist resorts, integrated resorts, and resort hotels required to pay the Green Tax – must exchange USD 500 per tourist arrival with local banks. This exchange must occur by the 28th day of the third month following the arrival month.

In his address, Muizzu highlighted the Maldives’ tourism industry’s significant contribution to the economy, generating USD 4.5 billion in revenue in 2023. However, he noted that only 1.5% of this amount was exchanged through banks, forcing state-owned enterprises (SOEs) and others to rely on the black market, which has inflated the unofficial exchange rate.

“We will not revise this regulation,” President Muizzu asserted. “They will have to exchange at the rate of USD 500, and compliance with this regulation is mandatory for all relevant parties.”

Muizzu outlined several benefits anticipated from the regulation. These include doubling the current USD 500 limit for locals travelling abroad to USD 1,000 by early 2026, ensuring access to foreign currency at official rates for SOEs by July 2024, and increasing credit card limits to USD 1,400 by 2025. He also announced plans to introduce a new forex act to strengthen enforcement mechanisms.

Despite the Muizzu’s assurances, the regulation has faced criticism from stakeholders within the tourism sector. Industry representatives have voiced concerns about potential economic repercussions, with some citing the recent closure of Champa Central Hotel as a warning sign.

Muizzu called on tourism pioneers to support the regulation, urging them not to allow political interference to hinder its implementation. The government remains optimistic about the policy’s long-term benefits, aiming to stabilise the forex market and reduce dependency on informal channels.

As discussions around the regulation continue, its impact on the Maldivian economy and tourism industry will be closely monitored.